Get Out of Debt: A Step-by-Step Guide

“Get out of debt!” the financial advisor yelled, then provided exactly zero examples of how to do so. Sound familiar? It’s widely agreed upon that the first step toward financial security and growing wealth is to eliminate your debt, which is why countless articles and advice columns start like this:

“Step 1: Get Out of Debt”

And then they move on to the next topic. This usually frustrates people dealing with outstanding balances and ghastly interest payments, as covering these expenses is rarely easy or straightforward. When the first thing you’re told to do is get out of debt but there’s no blueprint for how to do it, it can be really defeating.

So let’s talk about how you can get there. Let’s try to come up with some concrete steps for making it happen. This five-step plan comes with no guarantees and it might not be practical for everyone, but that shouldn’t stop you from taking action and doing what you can to lead a debt-free life.

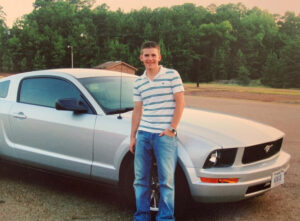

Take it from someone who got into a mountain of unnecessary debt at 19 years old. This is where I can say, “Thank God for a woman” – in all seriousness, this debt was a make-or-break moment in my and Megan’s relationship and we weren’t even married yet. It wasn’t long after the first couple of payments were due and left me with a gut-wrenching choice: Pay my rent, or pay for my car.

Yup… that’s me. 19 years old, brand new Mustang, custom license plate… Oh yeah, I was the epitome of “go big or go home.” Truth be told, I should have just gone home.

Step 1: Write It All Down

Think about your debt like a thief. When there are a series of bank robberies, the police will gather evidence in an attempt to find and stop the culprit. They don’t just acknowledge that banks are being robbed and then hope the crimes will stop. If you choose to ignore your debt instead of assessing it, you let it continue to run amuck; it keeps on robbing you, like a personal thief, and you just let it happen.

Beyond figuring out the total amount you owe and what your monthly minimums are, you need to pinpoint which balances have the highest interest rates, which debts have existed the longest, when different due dates are, and so on. Write all this information on a single sheet of paper so you can look in one place and understand the debt you’ve created.

Does writing down account balances make them go away?

It 100 percent does not. However, it does set you on the path to creating a budget and getting strategic with your debt management. With all this info at your fingertips, you can see how much you pay in total each month and then look for ways to move money around to work on higher-interest credit cards or fully eliminate smaller balances.

A succinct listing of your debts can also be easily factored into your monthly budget. When you make debt a top priority as you allocate your earnings, you’ll start throwing in a few extra dollars here and there to drive down the balances more quickly. If you feel like your problem is you simply don’t have enough capital to live and pay down debt at the same time, a detailed budget might help you alter that thinking.

Remember, this is the first of five steps. You won’t complete step one and suddenly have more money in your bank account. You will, however, feel a little more empowered to tackle your debt, and you’ll have the confidence to move on to step two.

Step 2: Set Achievable Goals

You can’t get out of debt if the only goal you set for yourself is to get out of debt. That may sound incredibly contradictory, but it’s true. While your endgame is to get out of debt, it’s a series of smaller goals that will help you reach that biggest milestone.

For example, a reasonable goal might be to reduce one loan by $1,500 in three months without starving yourself. This objective will drive you to meet a deadline without completely upending your lifestyle. Maybe you only pay $1,000 off the loan, or perhaps you surprise yourself and knock it down by $2,000. In either case, you have paid down debt.

Setting small goals allows you to keep larger goals in sight.

If you know how much money you’ll be putting toward a card each month, you can figure out when that balance will be completely paid off. As you chip away at one credit card, you can start thinking about the next one and figuring out how quickly that debt can be eliminated.

Your goals should go beyond just the amount you pay each month. You should also set goals to reduce spending in certain areas and to see how you might generate a little extra income. If your goal-setting shows that it’ll take 50 years to pay down your student loans, that might be a little depressing. Instead of dwelling on that information, make it your objective to have three yard sales in three weeks. Have friends over to sell stuff and hang out. Then put whatever you make toward your loans. It might not speed up the repayment process by much, but it will make you feel accomplished and a little more hopeful.

Most people who succeed in paying down large amounts of debt are very good goal setters. If you haven’t had much success in the past making plans and sticking to them, now’s the time to learn. Once you start checking things off your to-do list, you’ll start enjoying the process and making bigger strides.

Step 3: Start the Avalanche

Making that final payment on a credit card that’s been haunting you for years is an awesome feeling. Do you know what feels just as good? Rolling the monthly payment from the now-eliminated debt over to another card so you can pay it down faster.

As you lower balances and pay less interest, the money you throw at your debt starts to go further. If you have two credit card payments that each cost you $200 a month, eliminating one of them means you can put $400 toward the remaining card and work through that balance twice as fast. The more debts you settle, the quicker your debt-settling pace.

This is all very rudimentary, but it needs to be part of your debt-reduction strategy. If you don’t make a mental note to snowball your debt payments and get rid of balances more quickly, you might fall back into the irresponsible spending habits that got you into this financial mess in the first place. As soon as you let yourself lose momentum, it becomes easy to resume spending on the very credit card you had just paid down.

Stay the course!

The avalanche of money that will eventually lead to your debt’s demise should have some strategy behind it. You’ll hear different opinions about whether you should start by paying off your smallest balances or the cards that have the highest APR. People have strong feelings about this, but I think different strategies work for different people.

Getting rid of higher interest rates makes the most sense monetarily, as you always want to pay as little interest as possible. However, if you can quickly pay off a card with a balance of $500 and then immediately increase your monthly payments on a card with a bigger balance and higher APR, that’s not a bad strategy.

The important thing is to think through the repayment process and decide what will work best for your personal motivation. If you’ll be disheartened by how long it takes to pay down a credit card with an $8,000 balance, don’t start with that card. You may pay a few hundred dollars more in interest, but that’s a bargain. You actually pay down your debt instead of quitting.

A tiny pebble can start a giant avalanche, and that’s the mindset you should have with your debt. Increasing payments by a couple of dollars can get the ball rolling, and once you start picking up momentum, your debt won’t stand a chance. Then it’s on to step four, which is when the fun begins.

Step 4: Reward Yourself

The debt might not be gone completely, but you deserve a pat on the back for all your hard work. I know I said you should keep compounding your monthly payments to eliminate debt as fast as possible, but there’s no shame in celebrating when you achieve certain milestones.

If you pay down two of four credit card balances, buy yourself a nice dinner. Don’t do it on a credit card, but take a moment to enjoy the money you’re saving on interest now that half your debt is gone. If there’s an expense you dropped from your budget to get rid of debt, like going to the movies or Sunday brunches, you deserve a brief indulgence.

Aside from being happy with your reward, this special treatment can be an excellent motivator.

Seeing what can be done with extra funds might inspire you to try even harder to get out of debt. After you buy yourself a fancy lunch for the first time in months, maybe you’ll double your yard-sale efforts so you can put more money toward debts and eat out more often.

It’s also just important that life not get too dreary as you become more financially responsible. Reaching the goal of being debt-free will provide lots of happiness, but that doesn’t mean you have to ignore all of the finer things in life along the way.

It may be that debt relief is so fulfilling that your reward is paying down more debt. If that feels like a gift, go for it. Some people become enamored with the process and the idea of diverging from their strict budget while there’s still debt to be paid seems ridiculous. If you don’t want to buy a celebratory coffee, you certainly don’t have to.

Hopefully, you’ll reach a point where you’re paying down balances and don’t feel guilty about small rewards. If you’ve changed up your lifestyle to save money and fix your finances, you definitely deserve to acknowledge those efforts – especially because you’re almost at the final step.

Step 5: Stay Out of Debt

Um… that’s it? There’s still debt to be paid and the final stage of this brilliant plan is to… stay out of debt?

That’s exactly right. Think about how your debt came to exist in the first place. Maybe you took out some student loans or bought a car, or maybe you just started spending on a credit card and before you knew it, you owed Bank of America a few thousand dollars. No matter who you are or what you do, spending money is way too easy.

As you near your goal and the final balance that’s been holding you back, your strategy should turn from how you spend on debt to how you save for future expenses. Even while you have outstanding balances, you should be putting money into an emergency fund. People with lots of debt find this concept baffling, as saving money and getting out of debt seems to be in direct conflict.

The truth is, when you don’t have money saved to cover unexpected expenses, the result is always increased debt.

If your debt came to be because you got in a car accident and suddenly had to finance a new vehicle, that’s the type of negative balance issue that could have been avoided with some rainy day savings.

As your loan amounts and card balances go down and your monthly interest charges subside, squirrel some money away. Put it into an account that’s there just in case. It might seem like that money would go further paying down a Visa with a 20% APR. But you’ll be thrilled to have some savings when something pops up and you have no choice but to spend too much money.

Working on your saving habits will lead to better investing and money management once your debt is gone. With a good amount going into an IRA and other growth accounts, your wealth will keep building. Eventually, you won’t ever have to take on bad debt again. You’ll feel secure. Start buying yourself a coffee whenever you like without worrying about the cost.

Final Thoughts

There’s nothing easy about getting out of debt. Steps one through five present unique and substantial challenges. Don’t get discouraged when you run into trouble and don’t get balances paid down quickly.

The most important part of each step is simply making the effort. When you’re looking at hundreds of thousands of dollars of debt and thinking about paying it all off, it’s really easy to become overwhelmed. That suffocating feeling often leads people to continue spending irresponsibly as they accept crippling debt as a fact of life.

When you break the process into these five steps, you have a strategy to fall back on. Start listing your debts while you watch TV. Or, ride the bus and think of some achievable goals while you’re in the shower. Make a conscious decision each week to avoid some form of habitual spending. Put those extra dollars toward a credit card payment. There are lots of small steps you can easily take that will eventually lead to big results.

Now that we’ve got a roadmap, I can confidently tell you to go get out of debt. Stop thinking about the reasons you can’t and start adopting the practices that will eventually get you there. No matter how daunting the debt is, you have the power to beat it.

Taylor & Megan Kovar

The Money Couple

For more helpful money topics, follow us on Facebook. And be sure to read up on our blog!

Pick up a copy of our new book, The 5 Money Personalities: Speaking The Same Love & Money Language on our website!

0 Comments